TL;DR

Binance Launchpad and Launchpool offer users diverse opportunities in the crypto space, from early access to innovative projects to earning rewards through staking.

The Binance token launch platform provides a secure environment for both projects and users interested in joining crypto crowdfunding events.

The platform’s holistic support includes initial token issuance as well as guidance from Binance’s listing and investment teams.

Introduction

Binance Launchpad and Binance Launchpool are both part of Binance’s token launch platform. These platforms are designed to foster innovation by providing support to aspiring and existing blockchain projects.

Binance is constantly looking for strong crypto teams with a unique and innovative vision. Its token launch platform offers a full range of offerings, from advisory services during token issuance and launch to post-listing and post-launch marketing.

In this guide, we will cover what Binance Launchpad and Launchpool are, their differences, potential benefits, and how you can get involved as a user or project team.

Binance Launchpad: Pioneering Crypto Crowdfunding

Before Binance Launchpad, it was common for blockchain projects to raise funds and launch their tokens via independent crowdfunding events, known as Initial Coin Offerings (ICOs). However, this old school crowdfunding approach was often marked with technical failures, fraud, and a serious lack of user protection.

In 2019, Binance Launchpad was created, pioneering the concept of Initial Exchange Offering (IEO). The introduction of IEOs on Binance Launchpad caused an important paradigm shift in the crypto crowdfunding space, benefiting both blockchain projects and their supporters. Since then, projects have been able to raise funds, and users can support these projects in a safer and more convenient way.

The Differences Between Binance Launchpad and Binance Launchpool

Binance Launchpad and Binance Launchpool have similar goals and are part of the same Binance token launch platform. However, there are important differences between the two.

Binance Launchpad was created in 2019 to introduce a new method for crypto crowdfunding. Binance Launchpool was introduced in 2020, allowing users to stake their assets to get new assets in return.

What Is Binance Launchpad?

As we’ve learned, Binance Launchpad is the pioneering platform for Initial Exchange Offerings (IEOs). It has revolutionized crypto crowdfunding by providing a secure and efficient means for transformative blockchain projects to raise capital.

Binance Launchpad prioritizes user and project protection, offering top-notch security during token sales and eliminating the need for projects to create their fundraising platforms, reducing susceptibility to attacks. It facilitates growth for deserving projects by providing exposure to millions of global users, ensuring world-class liquidity and multiple trading pairs post-launch.

In addition, the platform's holistic support includes initial token issuance as well as guidance from Binance's listing and investment teams, which carefully evaluate Launchpad applications. With Launchpad, crypto projects benefit from token launches within a trusted platform, leveraging Binance's status as the world's leading exchange to access a vast community of crypto holders and investors.

Binance Launchpad benefits

Early access to innovative projects

Safe token launch environment

Global exposure

Fair token distribution

World-class market liquidity

Professional guidance and support

What Is Binance Launchpool?

Binance Launchpool enables crypto holders to stake their assets to earn new tokens, combining the principles of DeFi yield farming with the security and convenience of a big exchange like Binance. Unlike Binance Launchpad, which primarily involves token purchases, Launchpool allows users to farm new assets and receive token rewards by staking BNB and other supported tokens at no cost.

There are multiple benefits to participating in Binance Launchpool. First, the process of earning new tokens is very simple: you deposit tokens into a pool and get rewarded with other tokens. The rewards are proportional to your subscription amount and time staked.

Binance Launchpool offers flexibility in earning and controlling tokens, allowing users to harvest pending rewards at any time and to unstake funds at their discretion. Also, the platform extends Binance's support to projects featured on Launchpool, offering advisory services, community engagement, and marketing reach.

Binance Launchpool benefits

Earn from staking. No purchase is required.

Flexibility and control.

Early access to innovative projects.

Safe token launch environment.

Global exposure.

Fair token distribution.

World-class market liquidity.

Professional guidance and support.

How to Access Binance Launchpad and Launchpool

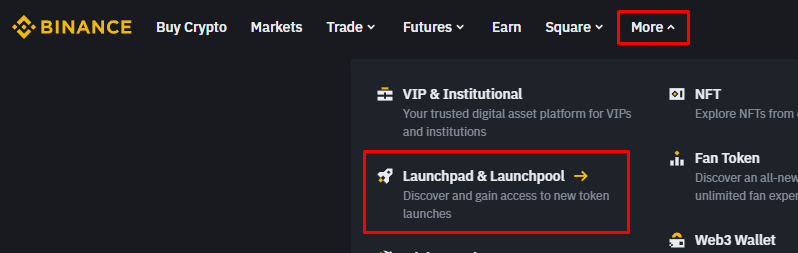

1. Log in to your Binance account and find [Launchpad & Launchpool] at the top menu.

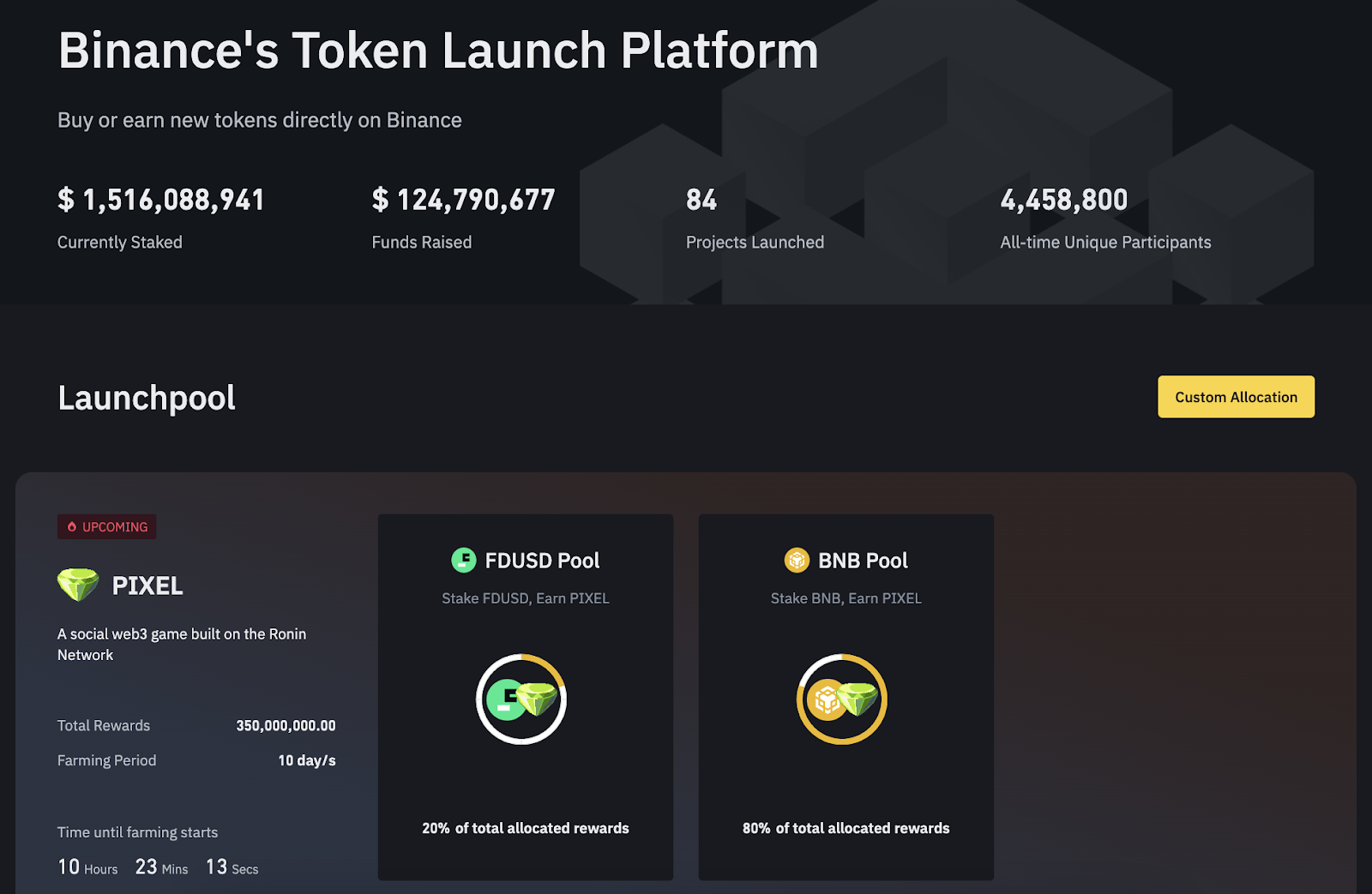

2. Next, you will see Binance’s Token Launch Platform page. The first section will show upcoming or active token sales (if any).

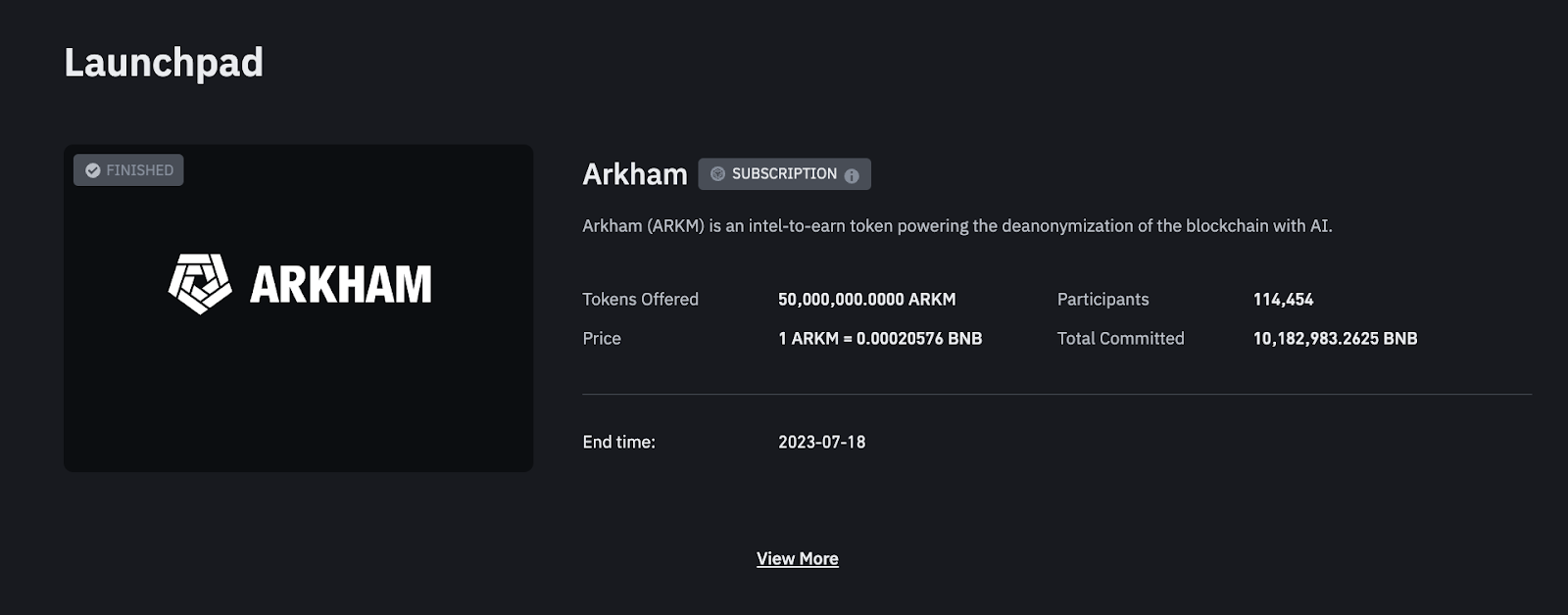

3. If you scroll down further, you will see the Launchpad section.

4. You can click [View More] to see all previously launched projects and their respective data. This will take you to a separate landing page.

You can switch from one section to another using the navigation buttons at the top.

How to Use Binance Launchpad

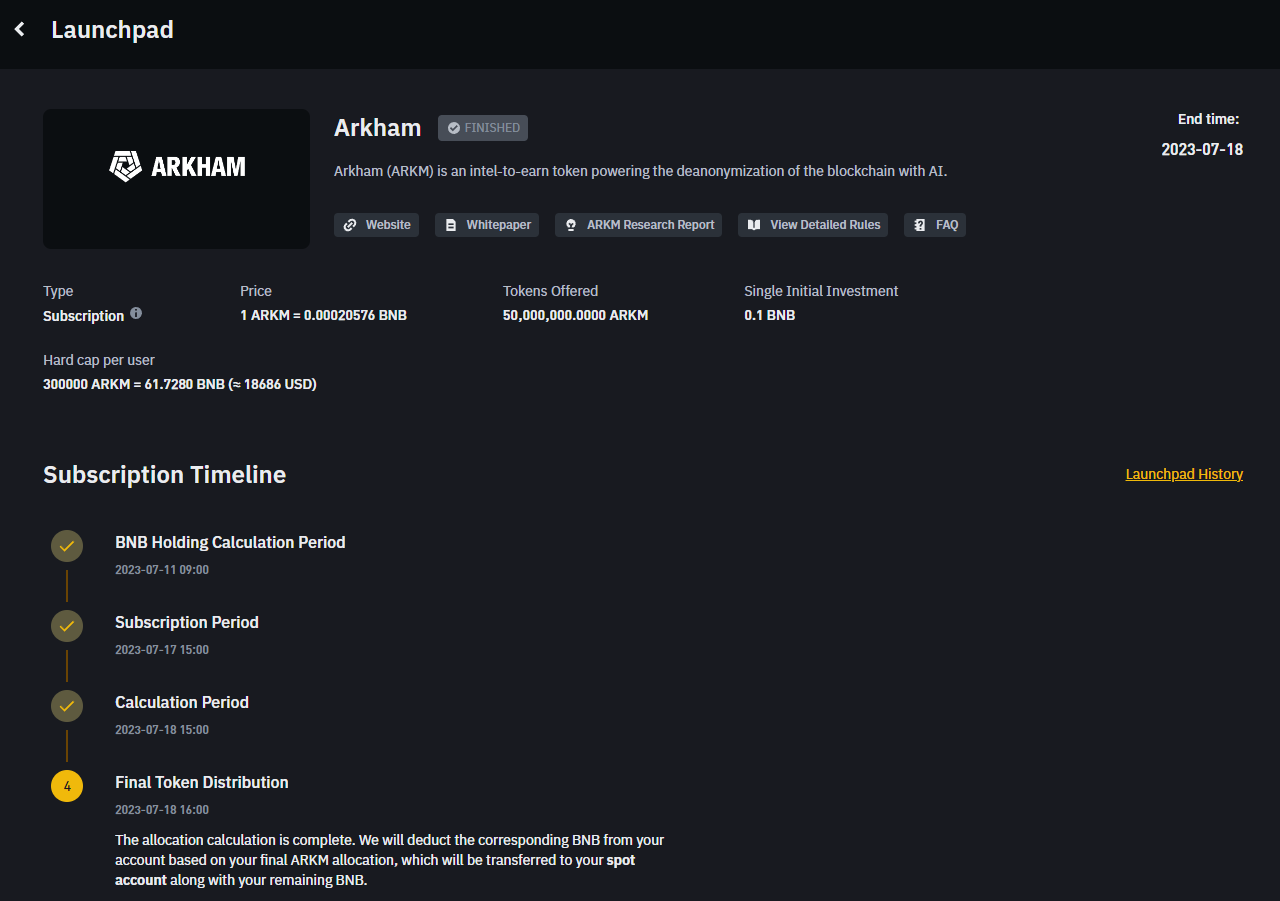

Binance Launchpad uses a subscription format. This means users have to commit a certain amount of BNB to the crowdfunding event (token sale). To join a Binance Launchpad token sale as an early supporter of the project, you have to hold some BNB in your Binance wallet and subscribe to the token sale during the subscription period.

Below is an example of a Launchpad token sale. The subscription period is closed, and the token sale is finished, but we can use the information as a reference. Notice that the token sale lasts a few days, from the BNB Holding Calculation Period to the Final Token Distribution.

This page also includes the project’s website, whitepaper, research report, detailed information about the sale rules, and an FAQ.

How to Use Binance Launchpool

Binance Launchpool uses a staking format, allowing users to acquire new token rewards by staking their existing cryptocurrency holdings. The stakes are usually done in BNB or a stablecoin like TUSD or FDUSD.

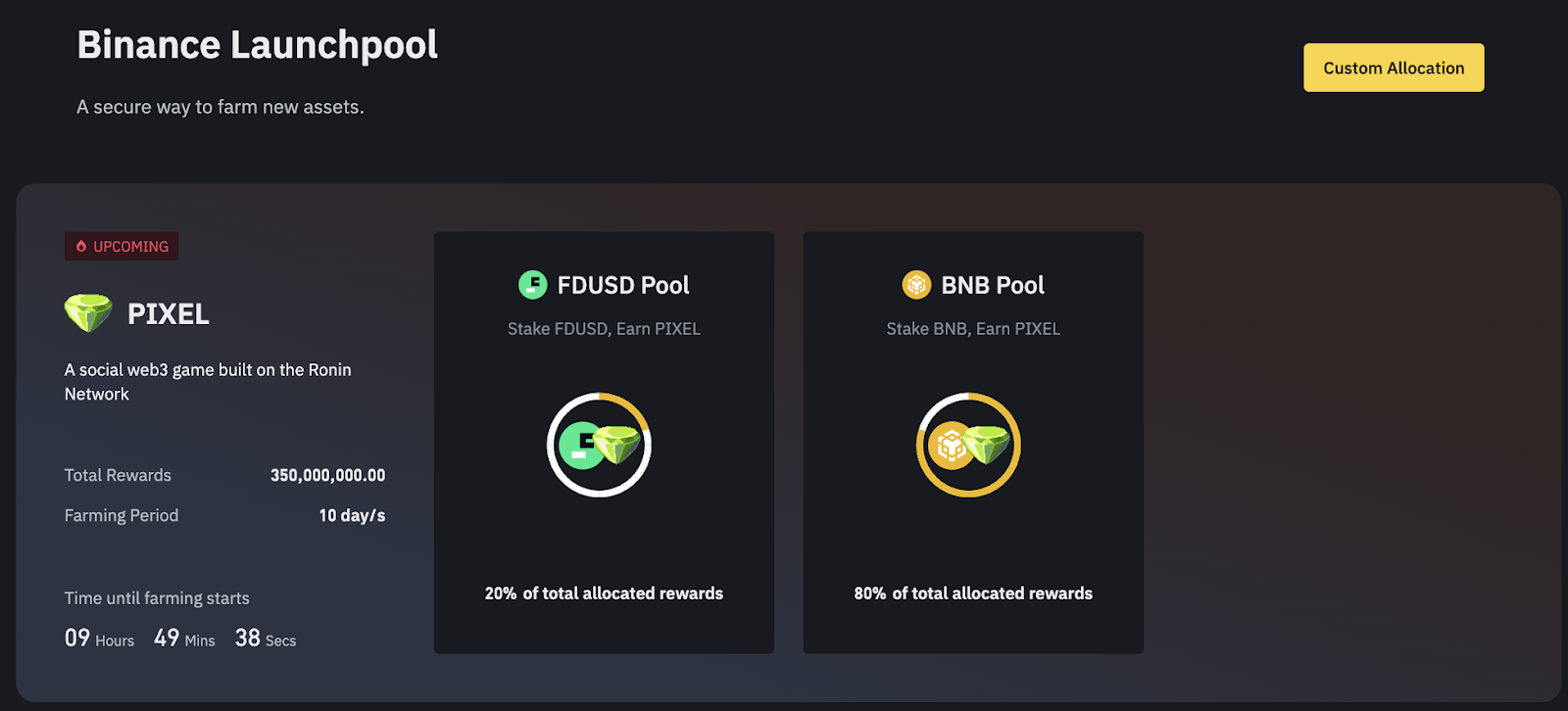

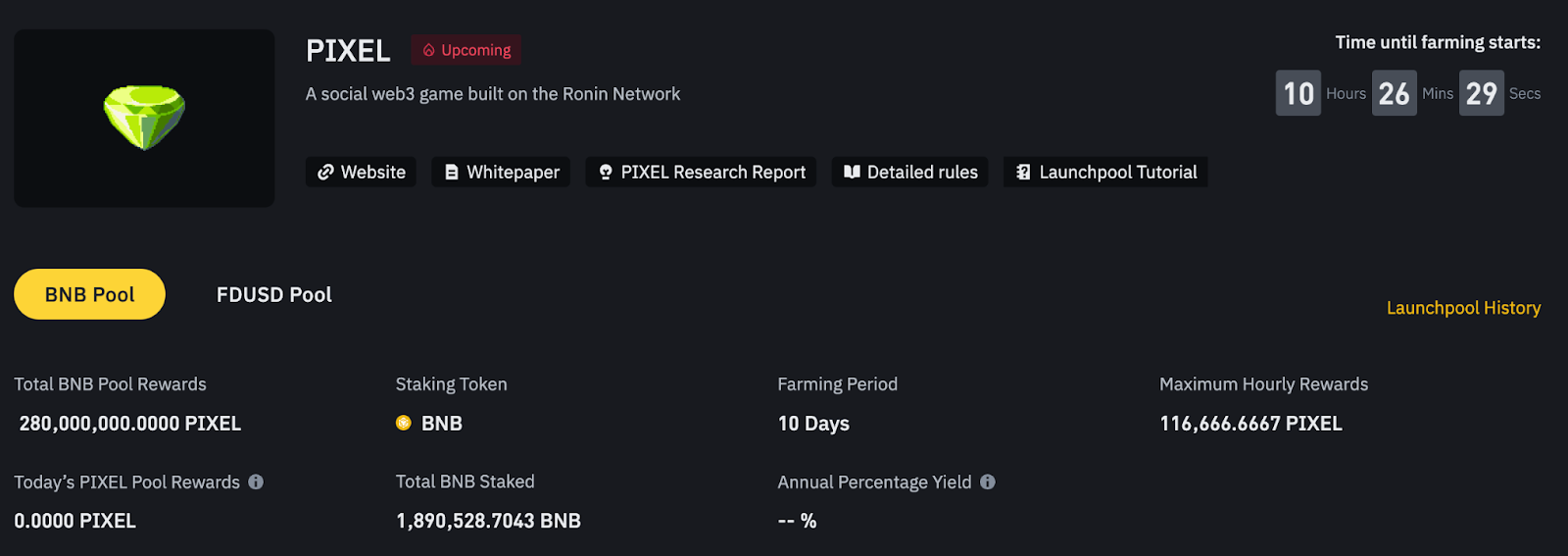

To participate, head to the Binance Launchpool page and find a project you want to support that is currently open for farming.

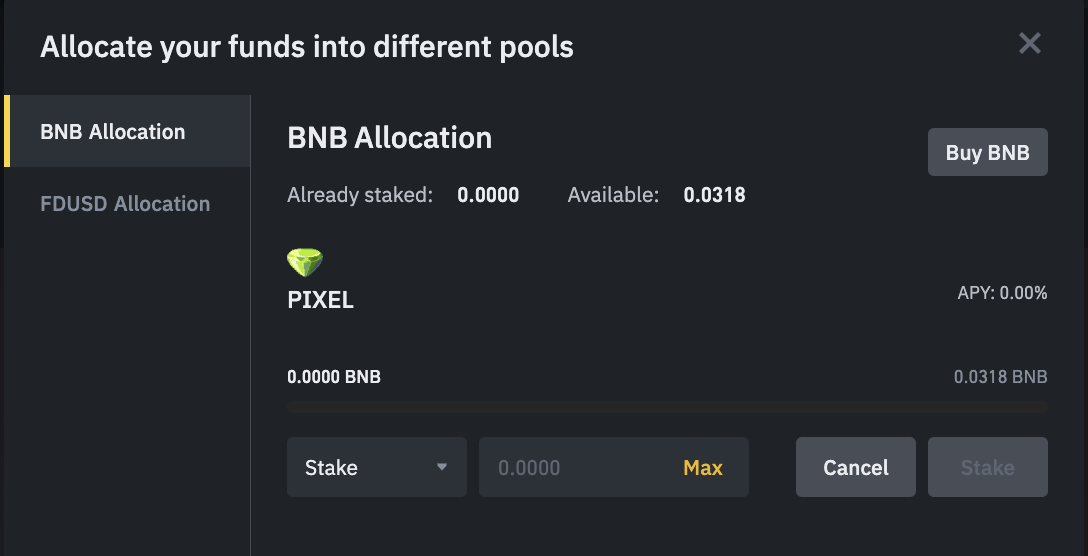

In this example, there are two farming pools, one for FDUSD and one for BNB. If you have both tokens, you can allocate your funds into different pools by clicking [Custom Allocation].

The total rewards, farming period, supported tokens, and APY estimate will vary from project to project. After staking your assets, you will start earning the project tokens. When the farming period is over, your staked assets and all earned rewards will be sent automatically to your Binance Spot account.

Closing Thoughts

Binance Launchpad and Launchpool are powerful tools for crypto enthusiasts, offering access to new projects, exclusive token launches, and opportunities to earn staking rewards. As Binance continues to innovate, users can navigate the crypto landscape confidently, leveraging these token launch platforms for growth and engagement.

Further Reading

What Is an Initial Exchange Offering (IEO)?

What Is Yield Farming in Decentralized Finance (DeFi)?

What Is an Initial Coin Offering (ICO)?

Disclaimer: This content is presented to you on an “as is” basis for general information and educational purposes only, without representation or warranty of any kind. It should not be construed as financial, legal or other professional advice, nor is it intended to recommend the purchase of any specific product or service. You should seek your own advice from appropriate professional advisors. Where the article is contributed by a third party contributor, please note that those views expressed belong to the third party contributor, and do not necessarily reflect those of Binance Academy. Please read our full disclaimer here for further details. Digital asset prices can be volatile. The value of your investment may go down or up and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance Academy is not liable for any losses you may incur. This material should not be construed as financial, legal or other professional advice. For more information, see our Terms of Use and Risk Warning.